A Strong Start to the 4th Quarter of 2009 !

A Strong Start to the 4th Quarter of 2009 !

The availability of bank-owned listings has dipped while available short sale listings continue their decline. Demand remained very strong in the current market for October. REO listings have dropped to around 2100 available listings in the Las Vegas, North Las Vegas, and Henderson areas while available short sale listings have declined to nearly 4400. However, there are nearly 3900 available traditional listings. REO closings in September accounted for 64% of all single family residential (SFR) sales; that is down from 80% a few short months ago. Short sales transactions made up over 16% of August sales. But again – let’s not overlook the importance of sudden strength in Classic Closings”! Traditional sellers accounted for over 19% of all residential sales in October.

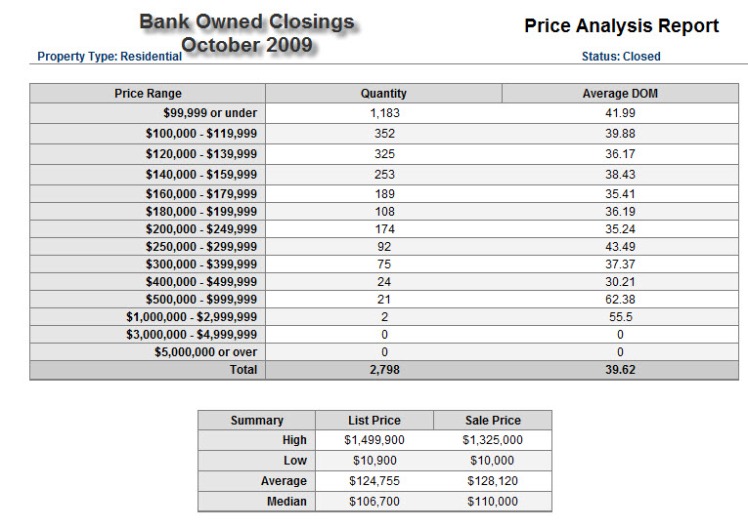

Let’s compare the price breakdown of all bank-owned properties in the Greater Las Vegas Area that closed in the month of October with the Classic or Traditional Closings. First here is the price analysis of bank-owned closings:

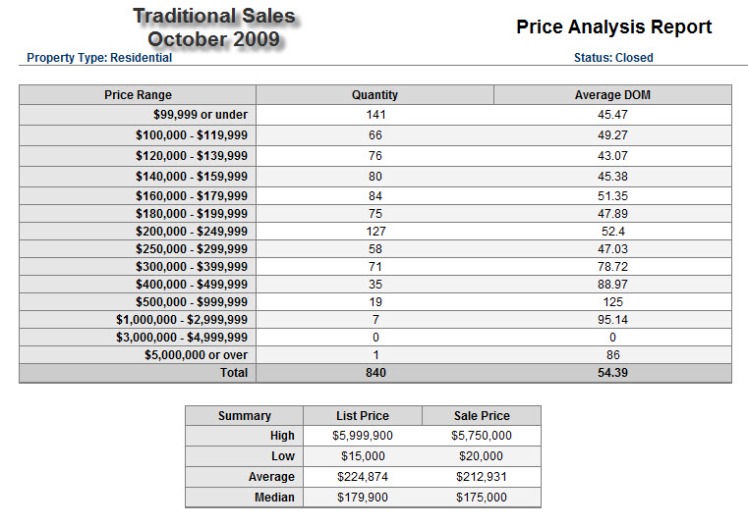

By contrast here is the price analysis of the Classic or Traditional Closings. What stands out here is the sales price range of traditional sales and the higher average and median closing prices.

Now let’s download the October 2009 Greater Las Vegas Market Stats for Single Family Residences listed under one million dollars. The “Available Homes” count dropped slightly as the closings remain at very high levels. This inventory drop combined with the increased sales activity resulted in a one month absorption rate of over 45%. Demand remains very high even as investor and first time buyer confidence grows in Las Vegas. Yet the most positive statistic for October was the modest increase in the median price of a Single Family Residence (SFR) which increased to $139,100. This represents the second monthly increase in the SFR median price in 18 months. However, the more volatile avegare price declined slightly indicating some short term downward price pressures that cannot be ignored

October closings sold according to the following terms:

- Cash 42% with an average sales price of $115,916

- Conv 24% with an average sales price of $198,888

- FHA 29% with an average sales price of $152,079

- VA 5% with an average sales price of $182,425

Market activity continues to be robust with demand and consumer confidence both soaring. Of course the best news is that Congress extended the First Time Homebuyer Tax Credit through April 2010 and expanded the program beyond first time homebuyers.

For additional information on statistics, absorption rates, or getting ready for you listing presentation, check out;