My Comments on Las Vegas REALTORS

It’s that time of year again where we install the new Officers and Directors of LVR. Although I am unable to attend this event, I will everyone well and certainly hope that 2026 will be a drama-free year for all. We have an excellent slate of Leaders on the 2026 BOD to accomplish that goal and move the members forward as we continue to embrace all of the market and real estate practice changes that have changed real estate as we have known it to be. But that’s good! Moving forward and embracing change is good! Congratulations to each of the 2026 Officers and Directors.

But now . . . my wish list! I only have one current item on my wish list for change at LVR. Please bring back mediations for consumers! LVR mediations were always welcome and warmly received by the public and attorneys alike. Consider that LVR mediators enjoyed and eighty- plus percent (80+%) rate when we conducted those mediations. Consider the very positive impact on our clients and the community!!

Current Las Vegas Market Individual Charts

Current Las Vegas Market Report

Market Overview

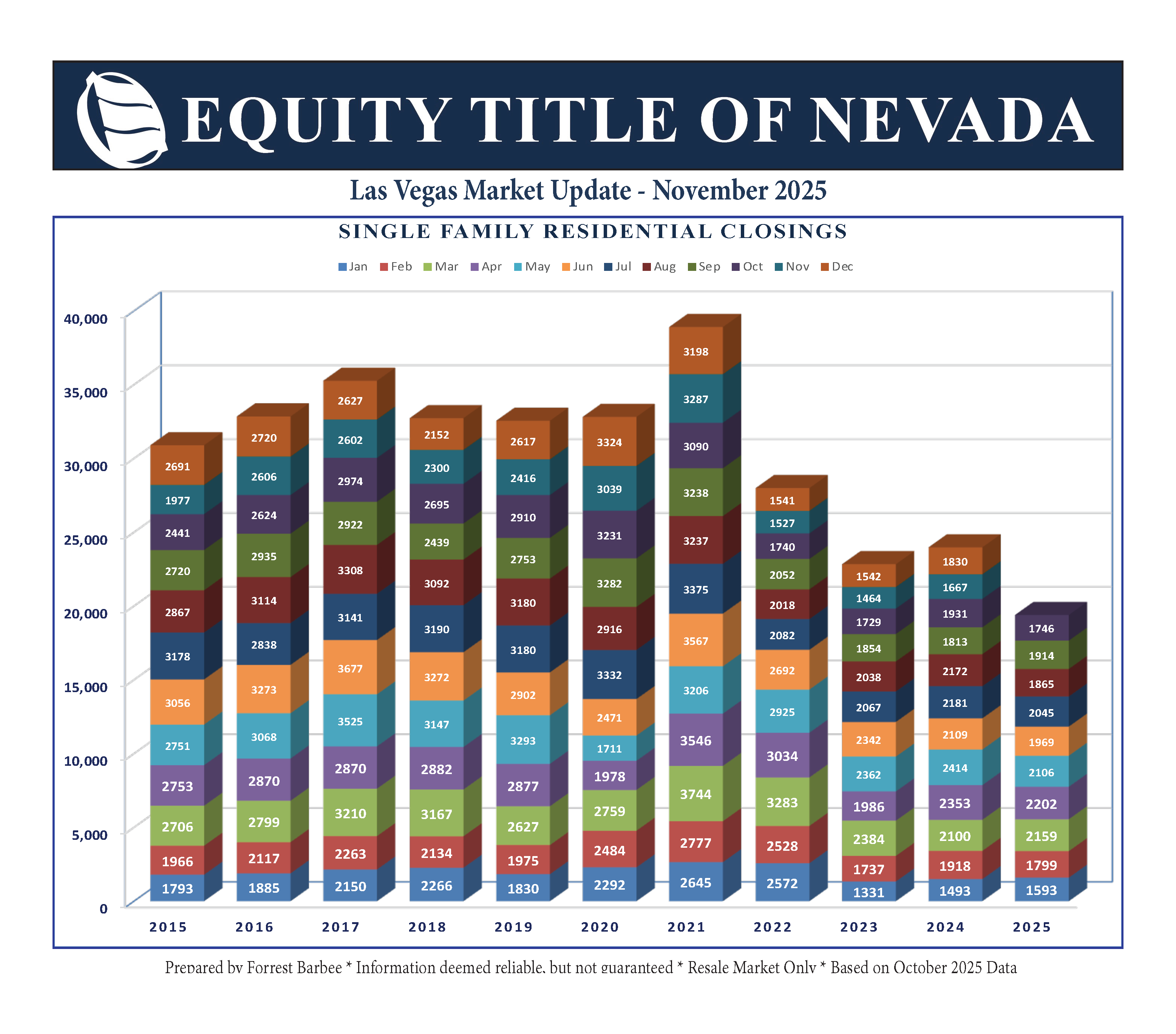

The Greater Las Vegas real estate market in October slowed down a bit from September. The result is that 2025 closed units moved up and is only 7.4% behind 2024 and while closed volume is only down 4.1% from 2024.

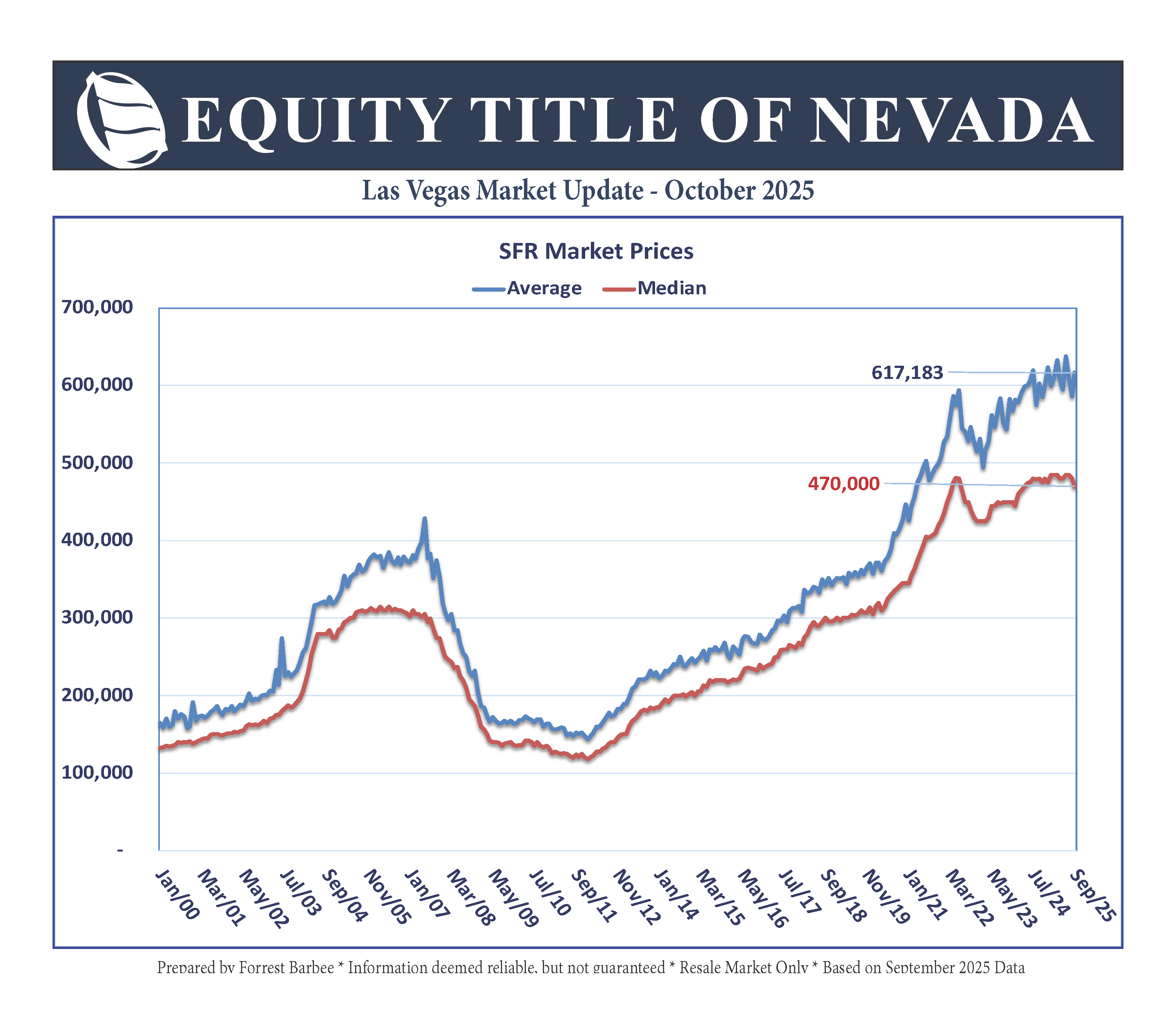

- the Median price of SFR improved from $470,000 to $471,500.

- the Average price an SFR closing inched up from $617,183 to $620,855.

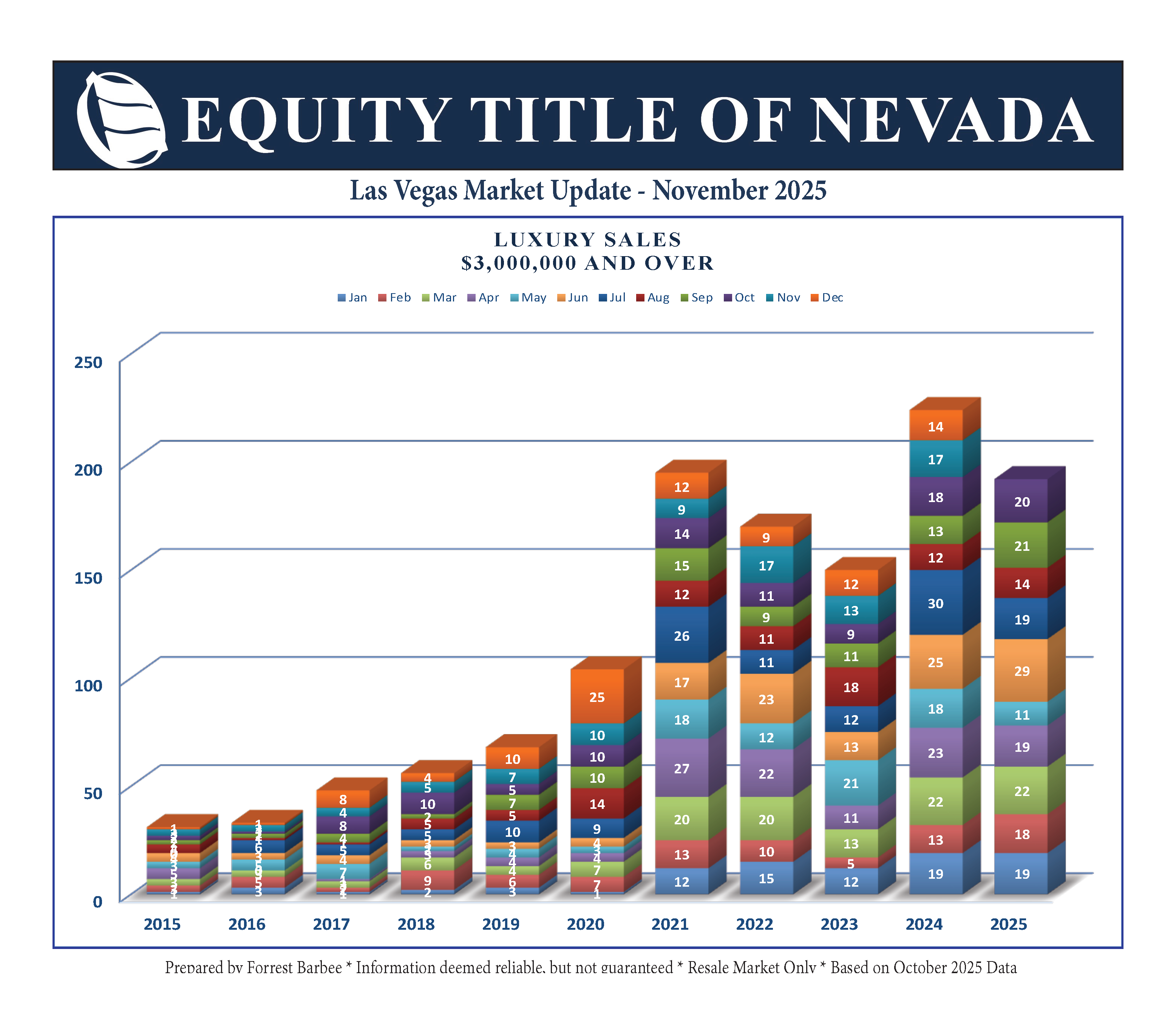

The luxury market closing prices drove the average sales prices higher and widened the gap between the median and average closed sales prices. In fact, the luxury market led the October market with 150 closings above $1 Million, including 20 above $3 Million.

Months of single family residential inventory increased to 5.3 months despite a few more closed sales, but not much improvement in new listings. Closings are never uniform across the Las Vegas area. Be sure to look at the “selected communities” report and notice that months of inventory range from three to twenty-one (21) months – depending on the community. Market performance has become increasingly localized, with supply and demand very different from one community to the other. This must be taken into consideration when preparing seller CMAs!