Let’s Talk Inventory!

Let’s Talk Inventory!

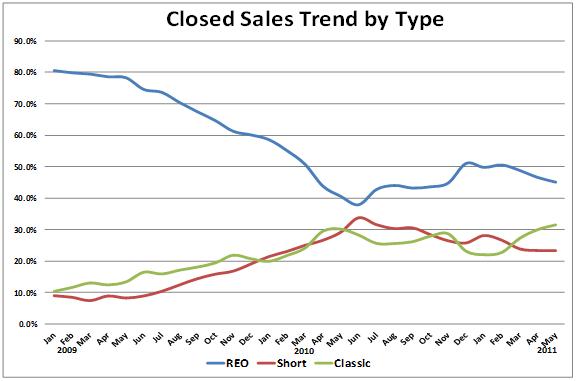

Single family residential (SFR) closings for May were nearly 1% better than April and 7.6% up from May 2010. The median sales price of an SFR improved to $126,000. Overall inventory held steady, but available REO inventory drifted higher and is approaching the 3400 level. Meanwhile Classic Closings continue to have the momentum as REO and Short Sale Closings continue to decline! The Henderson area benefitted from increases in average closed sales prices for both SFR and Condo/Townhouse sales.

Again, keep in mind that based on the 2010 Census—Nevada will gain a fourth Congressional seat. To keep up with Reapportionment & Redistricting or the current Legislative Session, please visit: http://www.leg.state.nv.us/.

For the complete Equity Title Market Update Report for June 2011 – Click Here.

Let’s Talk Shadow Inventory!

The entire discussion of “Shadow Inventory” is reminiscent of the Shakespearean comedy, “Much Ado About Nothing”. First, let’s remain cognizant of the fact that banks and mortgage companies have demonstrated their ability to manage bank owned inventory levels in this market. They have done this by delaying foreclosure proceeding after issuing a Notice of Default. They can elect to redirect the potential foreclosure into a short sale transaction, or even agree to a deed-in-lieu. Fannie Mae has even exercised their option to foreclose upon a property and then lease it back to the previous owner. So there are many ways that are available to banks who want to make a business decision to manage REO inventory levels in order to stabilize closed sales prices.

NAR recently released their First Quarter 2011 report for the Las Vegas Area. Click here to download. This reports contains a wide range of good economic information, but the last page of the report is the most interesting! Nevada ranks dead last on the list of states in terms of “months of shadow inventory”! New Jersey ranks #1!

The Case for Traditional Listings Continues

This month we continue to isolate SFR closings from the Residential Resale market to gain a different perspective on the Greater Las Vegas real estate market. The “Closed Sales Trend by Type” report on page 1 of this report illustrates the momentum that Classic sales continue to enjoy when compared to REO and Short Sale closings.

Thirty-two percent (32%) of all May SFR closings were classic or traditional sales. By looking only at SFR closings it can be seen that only 37% of traditional SFR sales were cash deals. Therefore, 63% of all SFR closings were financed with conventional loans leading the way. Notice too that VA loans make up 8% of this market segment compared to 5% when all property types are included.

Average Classic closing prices this month were 30% higher than Short Sale closings and 74% higher than REO closings. Both REO and Short Sales average sales prices fell in May; however, Classic Closings went from an average of $199,280 in April to $208,085 in May—nearly a 4.5% improvement!